In a world where rapid change is the only constant, the need to tailor strategies to the specific needs of local markets has never been more critical, especially in the near-term horizon of up to two years.

Near-term portfolio planning – the strategic management of a company’s portfolio at the local level – offers unique opportunities but also presents significant challenges for global pharmaceutical companies navigating diverse markets.

Effective brand and portfolio planning ensures businesses optimize performance, maximize returns, and achieve long-term objectives aligned with their mission. As market dynamics evolve, a well-crafted near-term strategy tailored to local needs can make all the difference in maintaining competitiveness and delivering meaningful outcomes.

The challenges of near-term portfolio planning

The core tension lies in the relationship between global and local teams. Consider a scenario where global teams prioritize the swift rollout of a new therapy, aiming for broad, overarching objectives to maximize portfolio value across markets. Local teams, however, may face regulatory, economic, or behavioral realities that complicate these directives. This disconnect can lead to misaligned resources and priorities, resulting in:

- fragmented communication

- inconsistent execution

- frustration across both levels

The challenge does not end there. When local teams operate in isolation, focusing solely on their unique dynamics without integrating global objectives, the approach risks becoming fragmented.

How to bridge the gap between global and local teams

The key lies in striking a balance between global cohesion and local personalization. Pharma companies must adopt a collaborative and adaptable approach to near-term portfolio planning, recognizing that both perspectives are essential for success.

From an external perspective, understanding local market and competitive dynamics – including market structures, treatment patterns, stakeholder behaviors, payer environments, and competitor intensity – is paramount.

Internally, decision-making must enable the co-existence of global and local strategies, ensuring that local plans are feasible and grounded in market realities while remaining connected to broader organizational goals (read more on ensuring global strategies reflect market diversity).

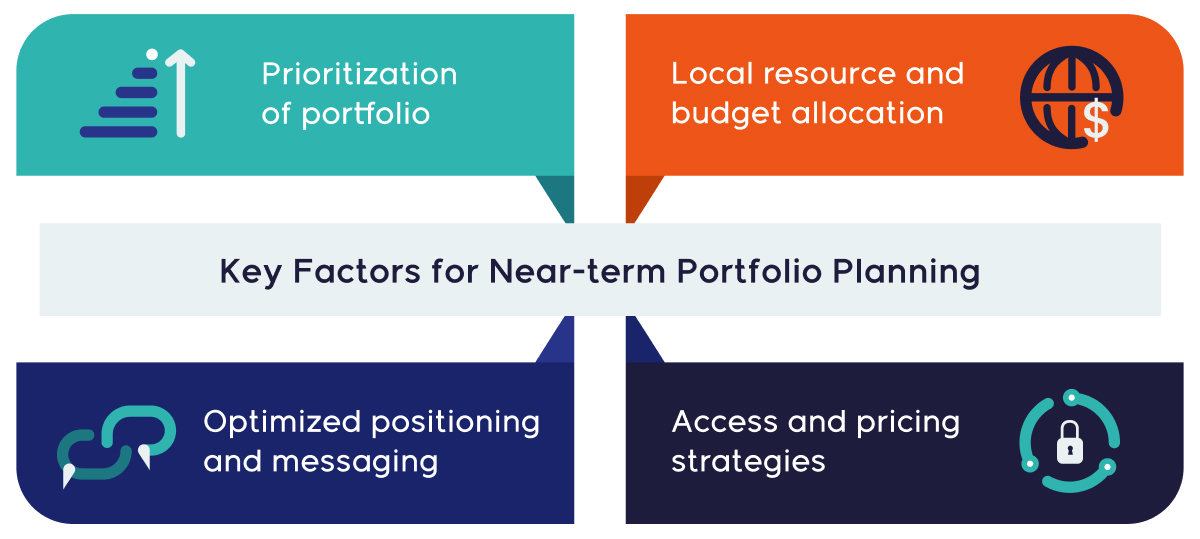

Key factors to consider when crafting near-term portfolio planning:

- Portfolio Fit: Prioritizing brands within the portfolio to elevate the company’s market position.

- Resource Allocation: Defining local budgets and acknowledging variations across functions.

- Access and Pricing: Aligning strategies both for individual brands and the portfolio as a whole.

- Positioning and Messaging: Optimizing stakeholder segmentation while considering product synergies and co-positioning.

Crucially, these external and internal factors must be evaluated not only for each individual brand but also for the broader portfolio. This dual lens ensures that while specific product strategies are maximized for local success, they also contribute to overarching portfolio goals.

Innovative approaches for optimized near-term strategic decision-making

An optimized near-term portfolio strategy thrives on collaboration between global, regional, and local teams. While some companies may attempt a “one-size-fits-all” approach, this often proves insufficient.

A singular strategy cannot account for the unique characteristics, dynamics, and challenges of individual markets, leading to misalignment and missed opportunities. In contrast, approaches that recognize and allow for greater local flexibility tend to be more successful and have greater buy-in from local teams.

Clustering

For situations with limited, but meaningful portfolio variation across markets, the development of market clusters/archetypes can effectively guide near term portfolio strategy.

For example, a company with three assets in the same disease area (but at different stages of their lifecycle) will require tailored guidance depending on local business maturity and competitive conditions. In one cluster, the focus might be on accelerating uptake of a newly launched product, maintaining momentum for a mid-lifecycle brand, and winding down investment in a product facing generic erosion. In contrast, another cluster may center around a robust post-LoE business with no imminent launch on the horizon. These clusters would naturally have distinct priorities and require differentiated strategic recommendations to guide portfolio planning effectively.

Cluster development improves efficiency and can also enable best practice sharing across similar environments. By providing a strong starting framework, clustering empowers central teams to support local markets while leaving room for their plans to be pressure-tested and refined for optimal outcomes.

Fingerprinting

For situations with significant greater variability across markets, cluster development can be ineffective. Either too many clusters are required to reflect local nuances, or the resulting groupings become overly broad – making them feel irrelevant to individual countries. The net result can be wasted effort and poor local adoption/implementation. In these situations, a more targeted fingerprinting approach can be effective.

This approach typically consists of two stages:

- Firstly, developing a range of potential portfolio growth levers that reflect the full diversity of markets and portfolio opportunities – this can include between 10 and 15 different levers as needed.

- Secondly, building a decision support framework that can guide countries through a common process to identify which levers should be prioritized considering their local environment. While the result of this process is a specific tailored local approach, alignment with the overall working set of strategic levers ensures fit with global strategy.

Key learnings

Near-term portfolio planning is about empowering local teams with the tools and insights needed to maximize portfolio value while maintaining global alignment. Approaches like clustering and fingerprinting help global teams support these efforts effectively. Success hinges on collaboration, adaptability, and nuanced understanding of market dynamics.

By fostering open communication and leveraging innovative approaches, pharmaceutical companies can craft strategies that resonate locally while achieving global goals. This balanced approach not only enhances product performance but also builds cohesion and trust across teams, ensuring sustained success in an ever-changing market.

Learn more about Align Strategy’s offerings in brand and portfolio planning, or alternatively please contact us to discuss your specific needs and areas for support. In the meantime, watch this space for our upcoming articles on portfolio management focused on how we evolve through mid and long-term planning with a strategic mindset in place.